Trump Gold Card Launch: What High-Net-Worth Investors Need to Know in 2025

Introduction: A New Era of Wealth-Based U.S. Residency

On December 10‑11, 2025, the Trump administration officially launched the Trump Gold Card program, introducing a new pathway to U.S. permanent residency for high net worth individuals. Unlike traditional investor visas like EB‑5, this initiative is contribution based rather than tied to job creation or business operations.

This program represents a significant shift in U.S. immigration policy and offers wealthy investors a fast track residency option but it also comes with unique compliance considerations and potential legal uncertainties.

Key Features of the Trump Gold Card Program

The Gold Card program allows foreign nationals to obtain U.S. lawful permanent residency by fulfilling specific financial obligations:

Individual Contribution: $1 million to the U.S. government, plus a $15,000 processing fee

Corporate Sponsorship Option: $2 million contribution per employee for corporate applications

Family Inclusion: Spouse and unmarried children under 21 may be included, with separate fees and contributions

Potential Platinum Tier: Expected $5 million contribution with added benefits (currently in waitlist)

This model removes traditional EB‑5 requirements such as job creation or TEA designation, making it an attractive option for investors prioritizing speed and simplicity.

Why the Gold Card Program Matters

The Gold Card is a strategic tool designed to:

Attract global capital and talent to the U.S.

Provide a fast-track residency option for ultra-wealthy individuals

Generate billions in government revenue, supporting broader economic initiatives

While this approach may appeal to investors seeking rapid U.S. residency, it is controversial because it effectively creates a wealth-based immigration track, raising questions about fairness and legal authority.

What Investors Should Know About Legal and Regulatory Risks

Experts have highlighted potential challenges:

Congressional Authority: The program’s legality is being debated, as creating new visa categories may require legislative approval

Two-Tiered Immigration Concerns: Critics argue it favors the ultra-wealthy, diverging from merit- or employment-based pathways

Ongoing Legal Reviews: Future court rulings could affect program continuity, approval timelines, or contribution requirements

Investors should stay informed and consult immigration counsel before initiating applications.

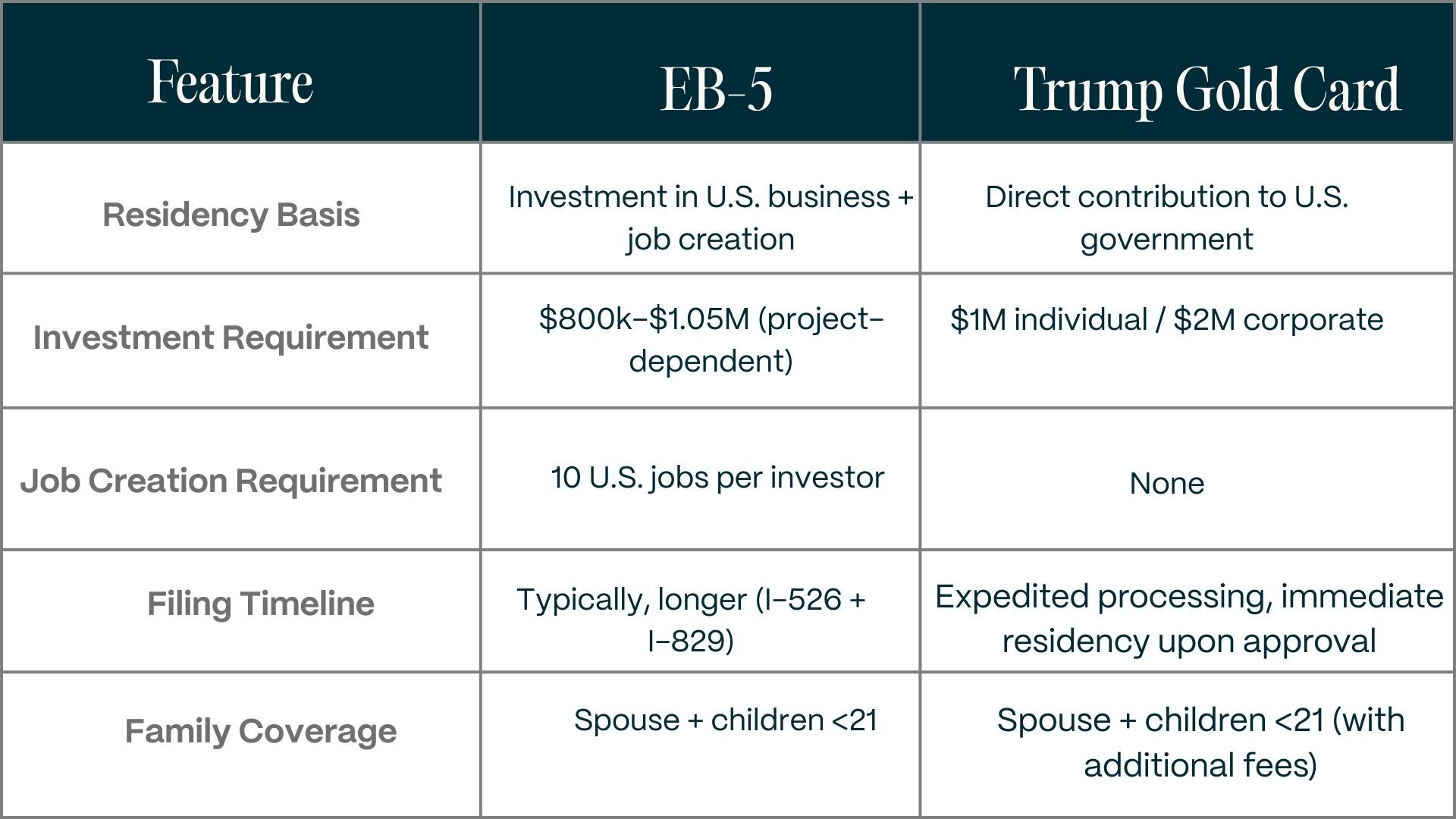

How the Program Differs From EB-5

This table helps illustrate why high-net-worth investors might choose the Gold Card over traditional EB‑5 primarily for speed and simplicity.

Who Should Consider the Trump Gold Card

The program targets investors who:

Can commit $1 million (or $2 million corporate) in direct contributions

Want immediate residency without managing business operations or job creation

Are seeking residency for family members along with personal immigration benefits

Are prepared for legal scrutiny and potential policy changes

Investor Checklist Before Applying

Before committing, investors should confirm:

Total financial obligations (contribution + processing fees)

Eligibility for family members under the program

Regulatory updates and potential legal challenges

Consultation with a qualified U.S. immigration attorney

Arcasia Advisors Insight

As USCIS amplifies project-level enforcement, selecting a compliant, well-structured EB-5 investment has never been more critical. At ArcAsia Advisors, we help investors evaluate project fundamentals, assess developer strength, and prepare filings that align with the evolving adjudication standards expected in 2026.

Disclaimer

This article is for informational purposes only and does not constitute legal or financial advice. Investors should seek independent professional guidance before making any immigration or investment decisions.