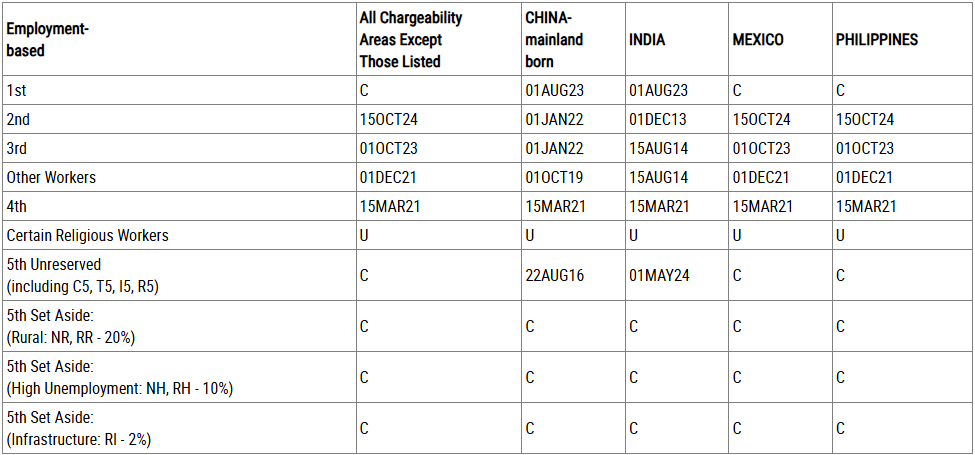

February 2026 Visa Bulletin: Why “Little Movement” in EB-5 Dates Matters More Than You Think

Introduction: Why Minimal Movement Can Signal Maximum Strategy

In immigration discussions, Visa Bulletin updates are often summarized in a single sentence: “No major changes this month.”

But for EB-5 investors in February 2026, little movement in priority dates is not neutral, it is strategic information.

A stagnant Visa Bulletin does not simply reflect administrative pacing. It often signals deeper realities about visa allocation pressure, category demand, and how quickly backlogs may develop later in the fiscal year.

Understanding what “no movement” really means can materially influence when and how investors should file in 2026.

The Structural Context: How the Visa Bulletin Impacts EB-5

The Visa Bulletin determines whether investors can:

Proceed with adjustment of status (if in the U.S.)

Schedule immigrant visa interviews abroad

Move from petition approval to green card processing

When dates remain unchanged, it typically reflects one of three underlying dynamics:

Demand is high but being carefully managed

Visa usage is approaching annual limits

USCIS and the Department of State are pacing allocations conservatively

For investors from high-demand countries such as India and China, stagnant dates often indicate that future retrogression risk remains real.

The Overlooked Dimension: Stability Is Not the Same as Safety

Many investors misinterpret limited movement as a sign that pressure has eased.

In reality, flat priority dates can mean:

The government is reserving visa numbers to prevent sudden oversubscription

Demand in reserved categories (rural, infrastructure, high-unemployment TEAs) is increasing

Future cut-off dates may adjust abruptly once quota limits are approached

In EB-5, stability can precede tightening.

The absence of forward movement today does not eliminate the possibility of retrogression tomorrow.

A Counterintuitive Insight: Slow Movement Favours Early Filers

It may seem logical to delay filing when the Visa Bulletin appears stable.

However, early filers benefit from:

Earlier priority dates before potential retrogression

Greater flexibility in project selection

Reduced competition in reserved visa categories

When dates are not advancing significantly, it often means visa demand remains steady and competitive. Waiting in this environment exposes investors to the risk of entering the system after cut-off dates tighten.

Historically, retrogression rarely happens gradually, it often happens suddenly.

Reserved Categories: The Strategic Buffer

One of the most important developments under the EB-5 Reform and Integrity Act (RIA) is the allocation of reserved visas for:

Rural projects

Infrastructure projects

High-unemployment TEAs

When general category dates show little movement, reserved categories may still offer relative flexibility.

Investors who file early in these categories often secure:

Priority placement within a limited allocation pool

Reduced exposure to country-based backlog pressure

Greater predictability in adjustment timelines

Timing Implications for 2026

February 2026’s minimal Visa Bulletin movement should not be viewed passively.

Instead, it signals:

Continued demand in key markets

Potential tightening later in the fiscal year

The importance of filing before mid-year visa usage accelerates

For high-net-worth families planning education, relocation, or cross-border structuring, early filing creates clarity in an otherwise uncertain timeline.

Strategic Takeaway for Sophisticated Investors

The Visa Bulletin is not merely a calendar, it is a pressure gauge.

For serious EB-5 investors, the critical question is not:

“Did dates move this month?”

But rather:

“What does this level of movement signal about future allocation risk?”

Those who understand how to interpret Visa Bulletin stagnation approach EB-5 differently. They recognize that waiting for obvious warning signs often means filing too late.

In a quota-driven program shaped by global demand, timing remains decisive, even when the Bulletin appears quiet.

This article is for educational purposes only and does not constitute legal or financial advice. EB-5 investors should consult licensed immigration attorneys and qualified financial advisors before making any decisions.